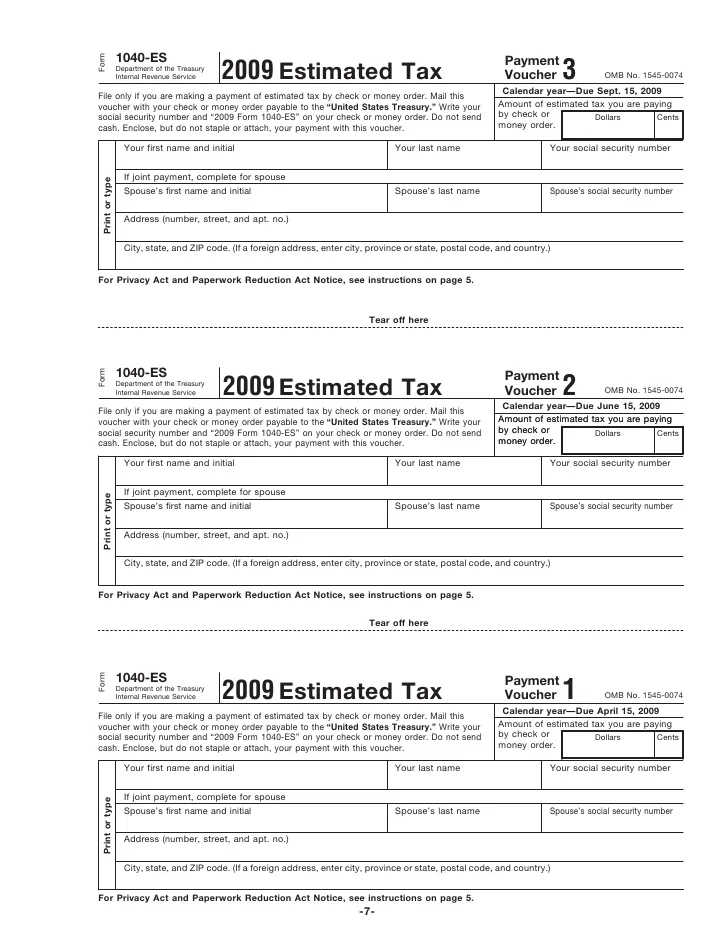

Estimated Tax Payments 2025 California. For more information, see estimated tax payments. Irs and california quarterly estimated tax payment due dates for tax year 2025:

Q4 estimated tax + deferrals (2025) january 16, 2025. Learn how to calculate, schedule, and submit california estimated tax payments accurately.

California Estimated Taxes For 2025 Due Dates Cynthy Martha, However, california grants an automatic extension until october 15, 2025 to file your return, although your payment is still due by april 15, 2025.

Estimated Tax Payments 2025 California Wynne Melantha, Q4 estimated tax for 2025 january 15, 2025.

California Ftb Estimated Tax Payments 2025 Zarla Kathryne, Avoid penalties and stay compliant with this comprehensive guide.

Estimated Tax Payments 2025 Dates And Forms Zenia Kordula, Enter your details to estimate your salary after tax.

How Estimated Taxes Work, Safe Harbor Rule, and Due Dates (2025), This is similar to the federal income tax system.

Estimated Tax Payments 2025 Forms Printable Roby Dianemarie, 100% of the prior year's tax liability.

Instructions For 2025 Estimated Tax Worksheet Jean Patrice, In this guide, we will explore the ins and outs of california quarterly estimated tax payments, including who needs to pay, how to calculate payments, important deadlines, and strategies for managing these payments effectively.

California Estimated Taxes For 2025 Due Dates Ulla Alexina, You can quickly estimate your california state tax and federal tax by selecting the tax year, your filing status, gross income and gross expenses, this is a great way to compare salaries in california and for quickly estimating your tax commitments in 2025.