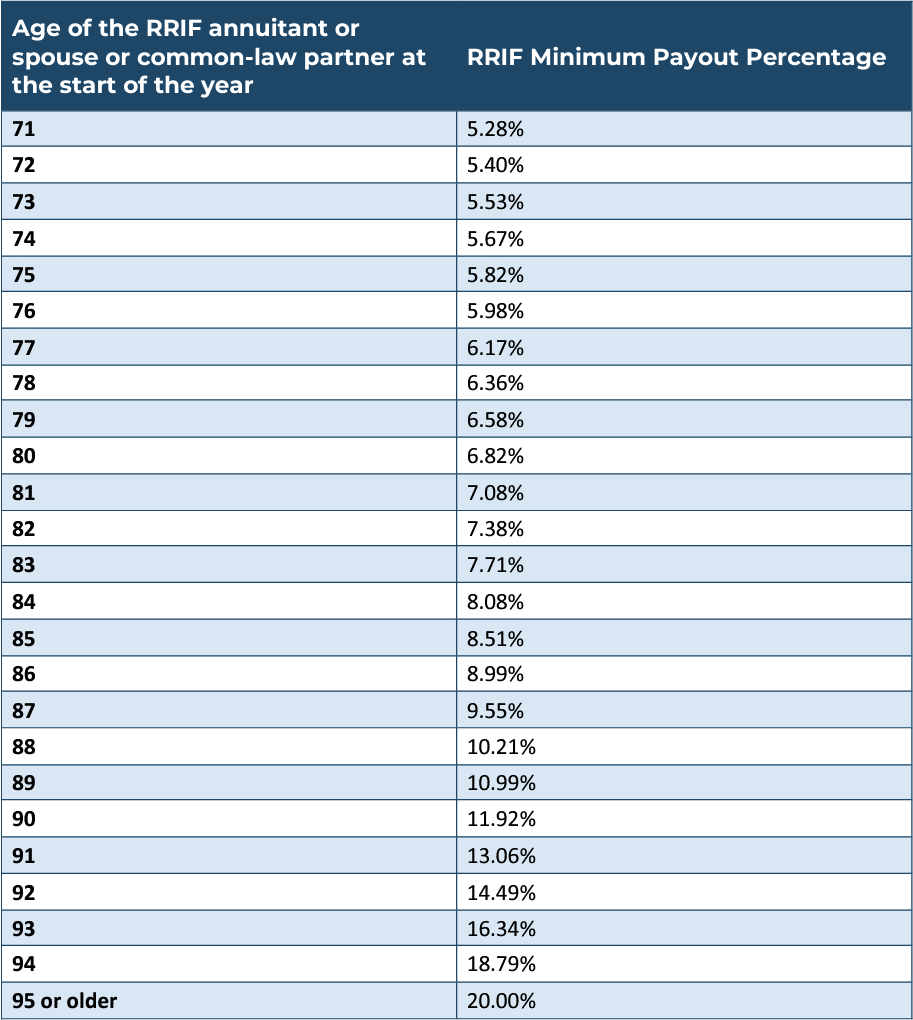

Lif Withdrawal Rates 2025 Canada. You may have to include other rrif amounts in your income, or you may be able to deduct other amounts for 2025. With a rrif being an account that is registered with the federal government, there are certain withdrawal age rules that must be followed.

When you withdraw funds from an rrsp, your financial institution withholds the tax. B.c., alta., sask., ont., n.b., n.l.

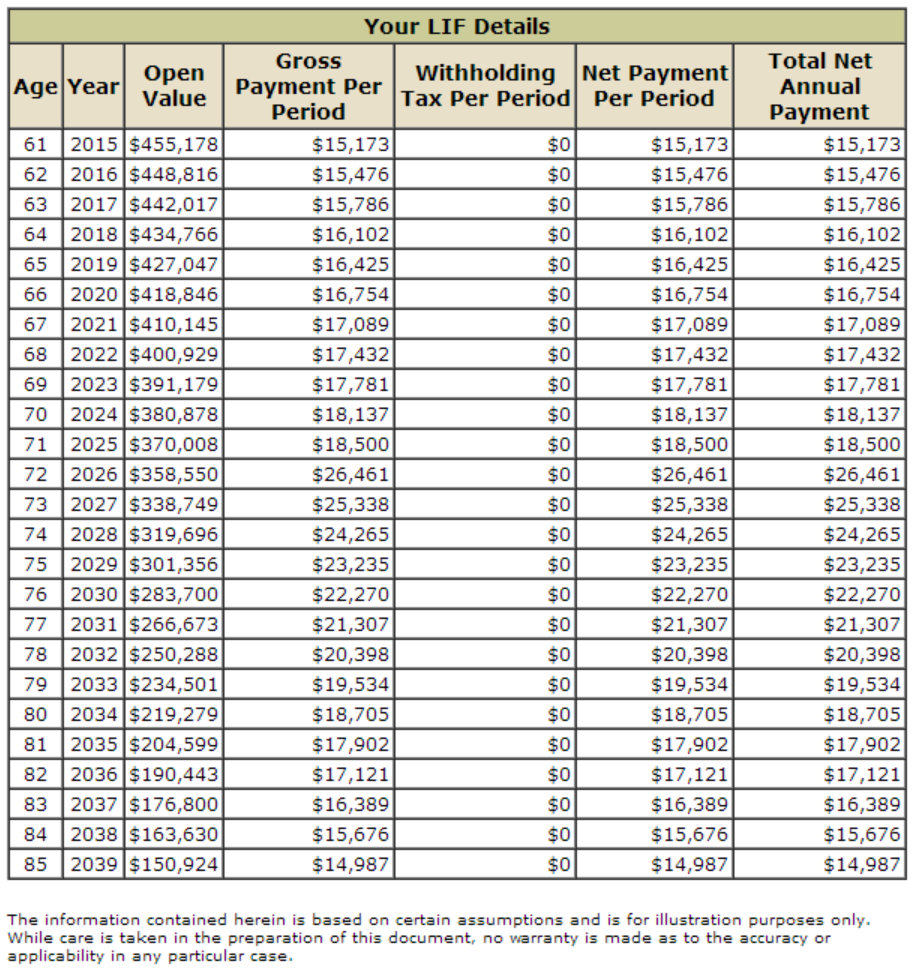

With a life income fund (lif), you have a minimum amount that you must withdraw, as well as a maximum amount that you are allowed to withdraw, each year.

2025 LIF Withdrawal Calculator 2025 LIF Minimum and Maximum, For federal and ontario lifs, a portion of the funds can be unlocked, subject to certain conditions and limits. When you withdraw funds from an rrsp, your financial institution withholds the tax.

RRIF and LIF withdrawal rates Everything you need to know MoneySense, Lif minimum and maximum withdrawal rates 2025. Other income and deductions from a rrif.

Retirement options for a DC Pension plan?, When you withdraw funds from an rrsp, your financial institution withholds the tax. The maximum withdrawal amount is based on your age at the beginning of the year, the value of your.

Eight Things to Know About RRIFs in 2025 Harvest ETFs, Other income and deductions from a rrif. Deadline for 2025 tax year.

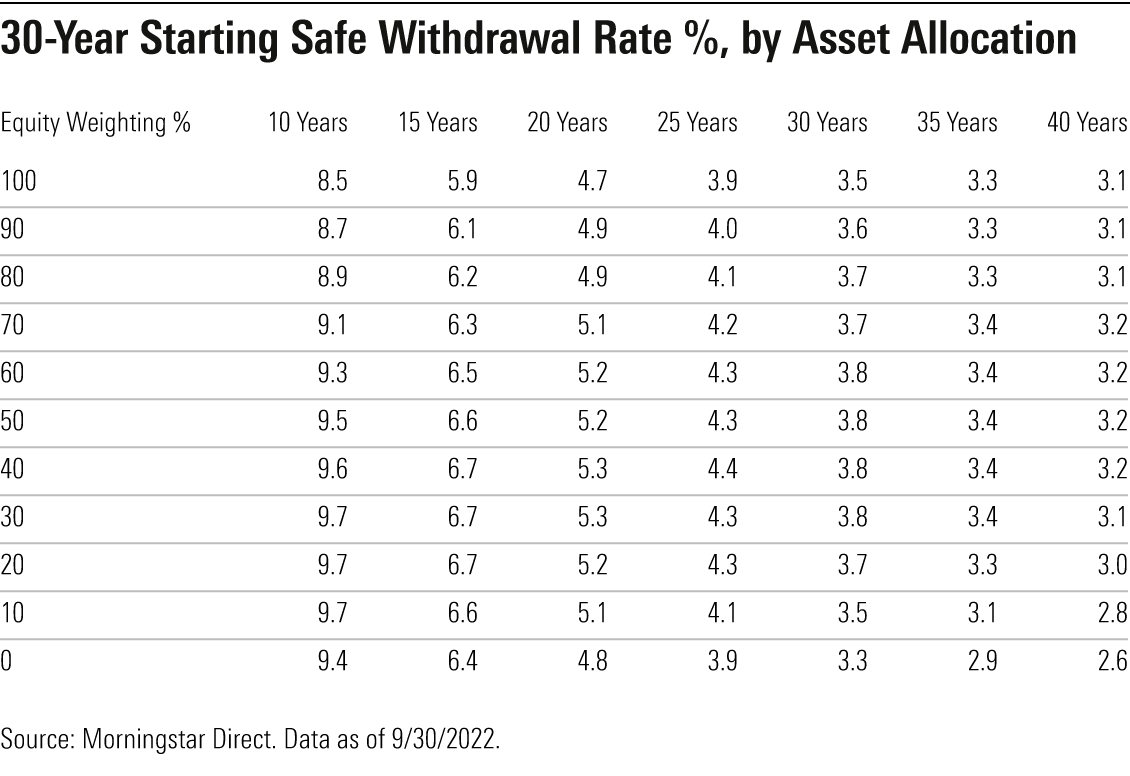

More Charts Withdrawal Rates and Portfolio Longevity — My Money Blog, With a rrif being an account that is registered with the federal government, there are certain withdrawal age rules that must be followed. The rates depend on your residency and the.

The Ultimate Guide to Safe Withdrawal Rates Part 2 Capital, These percentages were established by the government, and increase with your age. Life income fund (lif) interest rate and withdrawal.

2017 LIF Minimum and Maximum Withdrawal Rates, A lif follows rrif minimum withdrawal rules. The amount of money you can withdraw from your lif annually depends on your age (or your spouse’s age).

RRIF Withdrawals Advantage Wealth Planning, Lifs also have a maximum withdrawal amount every year. When you withdraw funds from an rrsp, your financial institution withholds the tax.

What’s a Safe Withdrawal Rate Today? Morningstar, When you withdraw funds from an rrsp, your financial institution withholds the tax. You are required in the calendar year to withdraw an amount between the.

What is a LIRA and how should you invest in it? My Own Advisor, Deadline for 2025 tax year. Generally speaking, you cannot withdraw a lump sum from an lif, as there.

For federal and ontario lifs, a portion of the funds can be unlocked, subject to certain conditions and limits.